I didn’t think I would come to Manila again so soon. Between my long drive to Kuantan, Pahang for Tone Excel’s Anniversary Dinner and the ‘most look forward to’ event of the year, DBA Surabaya Live, I wasn’t keen on squeezing in this trip to the Philippines in the short notice.

If not for the prospects of investing in property there.

In the last two months, I had been reading up books and any material on real estate investing in my off time, and viewed a few properties here in the Klang Valley for starters.

Sometimes I damn myself for not coming to this realization sooner. When I bought my houses in 2009 and 2012, I was so put off by the paperwork and tedious process – and weighing against my Online Business that is making money in US Dollars – I decided investing in real estate wasn’t worth the time and effort.

I’ve changed my mind.

I came to realization that even though I’ve been fortunate to run a successful, profitable online business selling my digital products for a decade already – who’s to say what will happen in the coming years?

A Facebook Post from a fellow online entrepreneur, Andrew Fox, caught my attention some time ago. He suggests buying properties for long term investing and cash flow despite running successful businesses. Paraphrased, “Which one do you think will have a higher chance of being around 10 to 20 years from now: your online business, or your property?”

I’ve ran this scenario many times in my mind if I were to be gone tomorrow – will my mother and sister be able to figure out my work and take over from here? How long can the sales I generate today last?

That decided it. Suddenly the paperwork and tedious efforts don’t seem so bad now.

Throughout a series of events and connecting around, I was able to get into this property investment tour to Manila, organized by Gerald Kong. The group consists of 6 people, a joint Malaysian/Singaporean group.

Three days in Manila with most of the action happening on the second day, we hopped from one location to another – checking out properties to consider investing in. Just as important, we did our homework and studied the environment and the people.

In the company of men old enough to be my father and so loaded they can buy floors of units, I was the rookie asking noob questions.

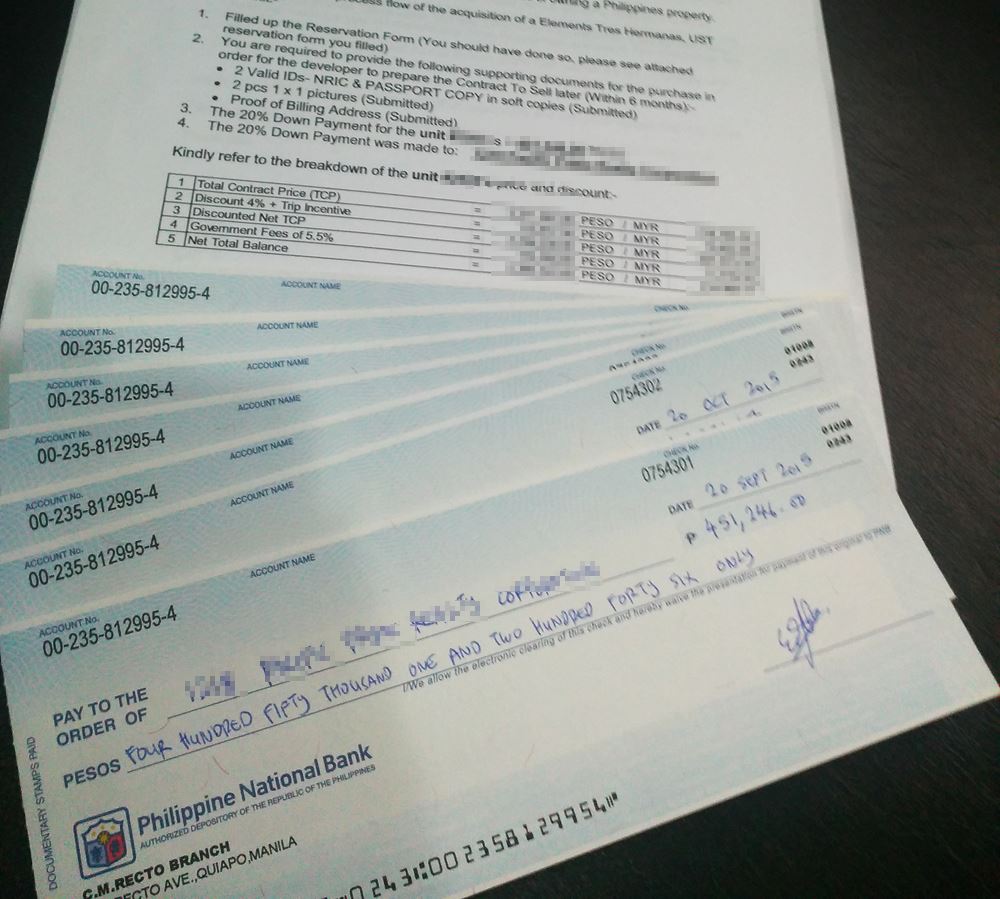

After coming back, I’ve put the down payment for my first property for investing… overseas. This shall be the first of many!

As I am writing this, the exchange rate is now $1 = MYR 4.3. I am more fired up than ever to continue crushing it online with my launches and promos, thus enabling me to save more for investing in properties (something I should have done 3 years ago instead of buying house for own stay but oh well, learn something new everyday)

Flying back gave me ample free time to day dream. I don’t know if I am crazy for dreaming this – and I don’t know how I am going to do it (yet) – I love the idea of having a 100 properties before 40.

No resting on laurels!